The Greater Hyderabad Municipal Corporation (GHMC) has made it easy for GHMC Property tax search and GHMC Property tax payment online through its official portals. Hyderabad, the capital of Telangana, is home to over one-fourth of the state’s population. As responsible citizens, it is our duty to pay our property taxes to the government. GHMC property tax can be checked and paid online without having to visit any office.

In this blog, we will provide you with a comprehensive guide to GHMC property tax, including how to search, payment, calculate, and manage your property tax.

GHMC Property Tax

The GHMC stands for the Greater Hyderabad Municipal Corporation. It is responsible for levying and collecting property tax in Hyderabad, the capital of Telangana. All lands and properties within the GHMC limits must pay GHMC tax as an urban development tax. This tax is mandatory and can be paid half-yearly or yearly. However, it is crucial to pay the tax regardless of the chosen payment frequency.

Paying GHMC tax has become much simpler with the introduction of the official portal. Through this portal, you can conveniently pay your GHMC tax, search for your GHMC property tax details, or calculate your GHMC tax. The revenue generated from property tax is primarily used to fund various civic services such as road maintenance, sanitation, street lighting, and education. Property tax plays a vital role in enabling the GHMC to provide essential services to the city’s residents

GHMC Property Tax Search

GHMC Property tax search can be done in portal by using mobile number or owner name or door number or house number. Prefered any one of this to know your ghmc property tax details.

- GHMC Property Tax by PTIN

- GHMC Property Tax by mobile number

- GHMC Property Tax by owner name

- GHMC Property Tax by house number or door number

GHMC Property Tax Search Process

GHMC Property Tax Search can be done by any of above mention ways. Follow below process to know your GHMC Tax PTIN number:-

- Go to the TS GHMC official portal:

- Click on the “Our Services” option and select “Property Tax“.

- After Select GHMC and Click on “Know your property tax details“.

- A new page will open. Select your GHMC circle and enter any one of the following fields:

- Mobile number

- Owner name

- Door number

- House number

- Click on the “Submit” button.

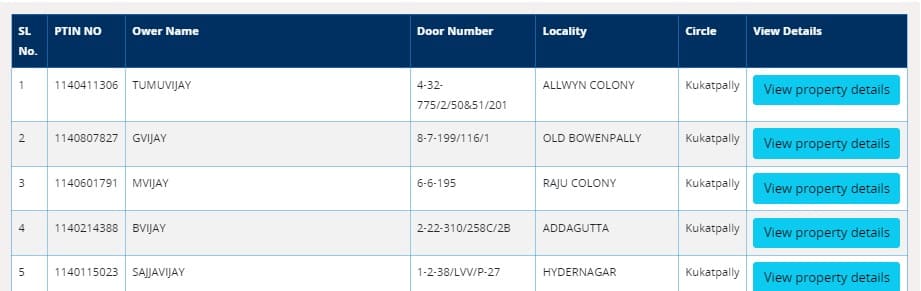

- A list of available tax details will appear. Check the list carefully and find your property. Click on “View your property details“.

- After Select your, and You will now see all the details of your GHMC property tax. Save your property tax PTIN number.

This is how you can get your GHMC Property Tax PTIN.

Know GHMC Property Tax by Mobile Number

- Visit the GHMC property payment portal: https://onlinepayments.ghmc.gov.in/

- Click on the “Property Tax” option in the left sidebar.

- A dropdown menu will appear. Select “Search your property tax“.

- Select your GHMC property tax circle and enter your mobile number and the owner’s name.

- Click on the “Get OTP” button.

- If your mobile number is linked to your property tax, you will receive an OTP. Enter the OTP and you will be able to see your PTIN number and other property details.

Note:- If your mobile number is not linked to your property tax, you will not be able to search for your property tax using this method.

GHMC Property Tax Payment Online

There are multiple ways to do ghmc property tax Online payment and offline. Normally ghmc property tax should pay every half yearly or yearly, it is mandatory otherwise penalties applied to your tax.

GHMC Property Tax Payment Different Ways:-

- GHMC Online Payment Portal

- MeeSeva Centre

- By Visiting GHMC Circle Office:

- In GHMC Municipal Office:

- Using Any Payment Apps:

GHMC Property Tax Payment Process

Now we will see how to do GHMC Property tax payment online through GHMC Payment portal.

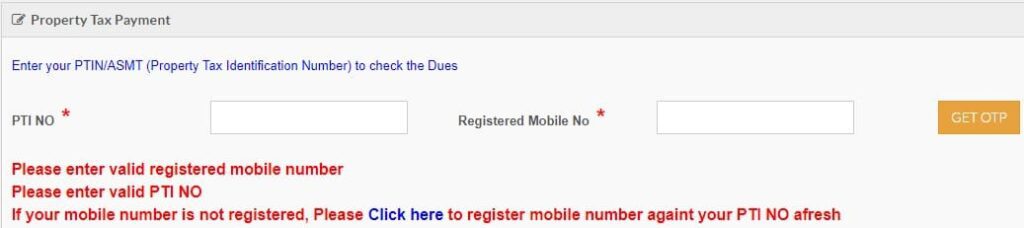

- Visit the GHMC online payments portal.

- Click on the “Property Tax” option.

- Select “Property Tax Payment.”

- Enter your PTIN number and registered mobile number.

- If your mobile number isn’t linked to your PTIN, click “Click here” to update it.

- An OTP will be sent to your mobile number. Enter the OTP.

- View your property tax amount and any outstanding arrears.

- Scroll down and choose your preferred payment method (credit card, debit card, net banking, etc.).

- Proceed with the payment.

- Once your payment is successful, download your tax receipt for future reference.

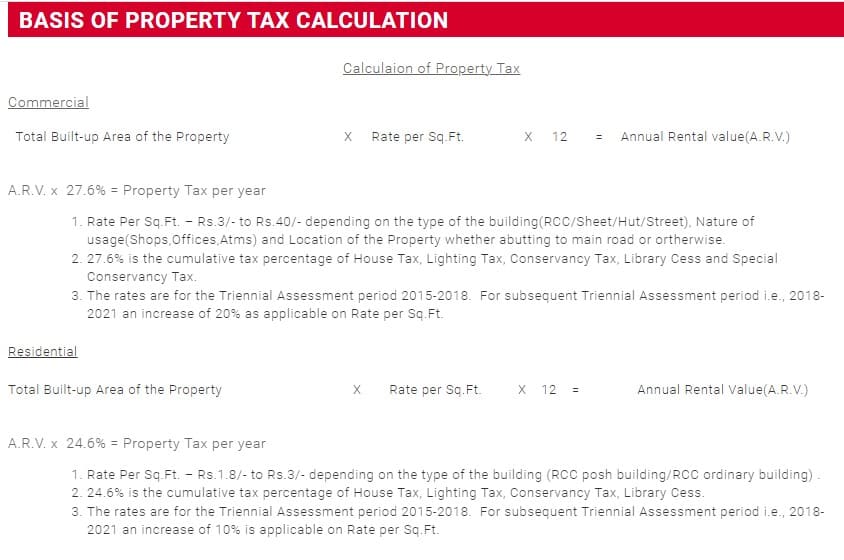

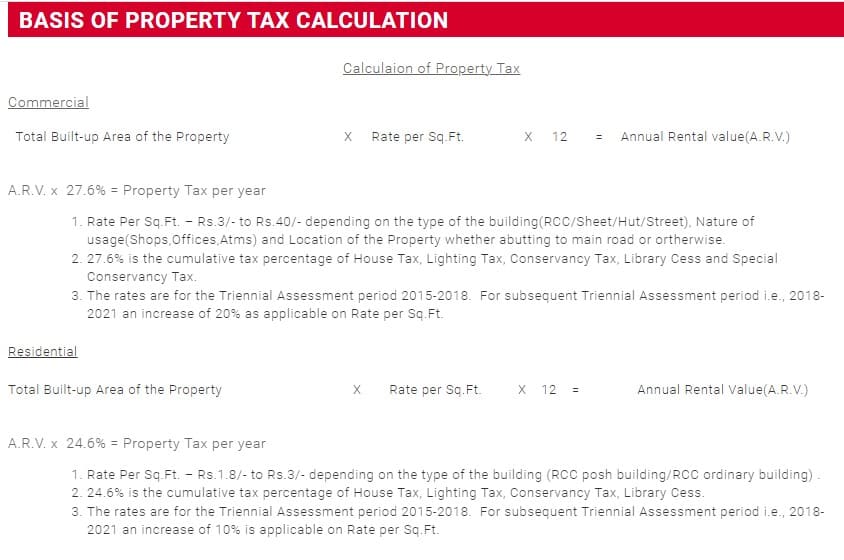

How to Calculate Your GHMC Property Tax Amount

- Step 1: Determine the building area of your property.

- Step 2: Find out the monthly rental value (MRV) per square foot of your property. You can do this by checking the recent rent-per-square-foot for similar properties in your area, or by referring to the GHMC’s official notification for specified MRVs in various circles and taxation zones.

- Step 3: Calculate your annual property tax using the following formula:

Residential Property:

- Annual Property Tax = Plinth Area (sq. ft.) x MRV (Rs./sq. ft.) x 12 x (0.17 – 0.30)

- Commercial Property:

- Annual Property Tax = 3.5 x Plinth Area (sq. ft.) x MRV (Rs./sq. ft.)

Coefficients:

- 0.17 – 0.30: This coefficient varies based on your monthly rental value. Refer to the GHMC website for specific rates.

Notes:

- The maximum MRV for commercial properties like ATMs and hoardings is Rs.70/sq. ft.

- The minimum MRV for commercial properties like educational institutions and hospitals is Rs.8/sq. ft.

| For Official example for this refer this PDF Click Here |

| To Read more about GHMC Property Tax calculation Click Here |

Paying GHMC property tax is a mandatory responsibility for all property owners within the GHMC limits, regardless of whether they are residential, commercial, or industrial. By following the simple steps outlined above, you can easily search for your PTIN, make payments online, and even calculate your property tax liability.

It’s important to remember that property tax amounts can vary depending on the type of property and its location. You can find the latest information and rates on the official GHMC portal, which is also constantly updated with any changes in rules or regulations.

Thank you for reading our blog! We hope this information has been helpful.