The TS CDMA portal offers a wide range of services for residents of CDMA areas, which are regions comes under the municipal administration. TS CDMA property tax is one of the key services offered on the portal, enabling users to handle all aspects of property tax management, including property tax search, tax payments, assessments, mutations, corrections, door number searches, and tax receipt downloads. This portal makes easy the process of finding property tax details for residents of CDMA areas.

TS CDMA Property Tax

CDMA Full form is Commissioner and Director of Municipal Administration.

CDMA property tax is applied to all residential, commercial, and industrial structures. The tax amount varies from place to place and is typically paid yearly or semi-annually to your local municipal body. CDMA tax applies to municipal administration areas, while GHMC tax or other taxes apply to remaining areas. CDMA also provides a tax calculation option that allows you to estimate the approximate tax for your property.

Property Tax Services Available in CDMA Portal

- Self Assessment

- Mutation

- Tax Calculation

- Certificates Download (Assessment & Mutation)

- Property Tax Payment

- Property Tax Payment By Door No.

- Search Your Property Tax

- Boduppal New PTIN search

- Print Receipts

- Check Your Payment Status

- View Assessment Details

TS CDMA Property Tax Search

CDMA property tax information can be easily searched using any of the following criteria: owner name, door number, PTIN number, assessment number, mutation number and you must need property district and ULB (urban local body)name. With any of this information, you can easily find the property tax PTIN number.

- Visit the TS eMunicipal Portal

- On the left sidebar, locate the “Online Payments” option and click on it.

- A dropdown menu will appear with various services. Select the “Property Tax” option.

- On the right side of the page, choose the “Search Your Property Tax” option.

- Enter your district and ULB (Urban Local Body) information. Below, enter either the owner’s name, door number, or PTIN number accurately.

- Click on “Search Property Tax.” The available records will appear.

- Locate your property record and click on the “View Details” option.

- All available CDMA property tax details will be displayed, including past payments and dues.

Know Your CDMA PTIN for Merged GP’s

Due to the merger of some gram panchayats into municipal administrations, PTIN numbers have changed for affected properties. To facilitate easy access to information for all concerned, the CDMA has introduced a new PTIN format for the merged gram panchayats.

- Visit the e-municipal portal.

- Locate the “Online Payments” option.

- Click on the “Property Tax” option.

- Under “Services,” select the “Get Your PTIN Number” option.

- Choose your district, ULB, and merged GP.

- Enter your old PTIN number in the PTIN field.

- Your new merged GP PTIN number will be displayed.

- Click on the “View Details” option to check your details.

CDMA Property Tax Payment Process

- Visit the TS eMunicipal portal

- Go to the TS eMunicipal portal

- Find the Online Payments option

- On the left side of the homepage, look for the “Online Payments” option.

- Click on the “Online Payments” option.

- Select Property Tax Payment

- A drop-down menu will appear with a list of available services.

- Select the “Property Tax Payment” option.

- Enter your PTIN number

- On the right side of the page, enter your PTIN (Property Tax Identification Number) in the “PTIN Number” field.

- Click on the “Get Details” button.

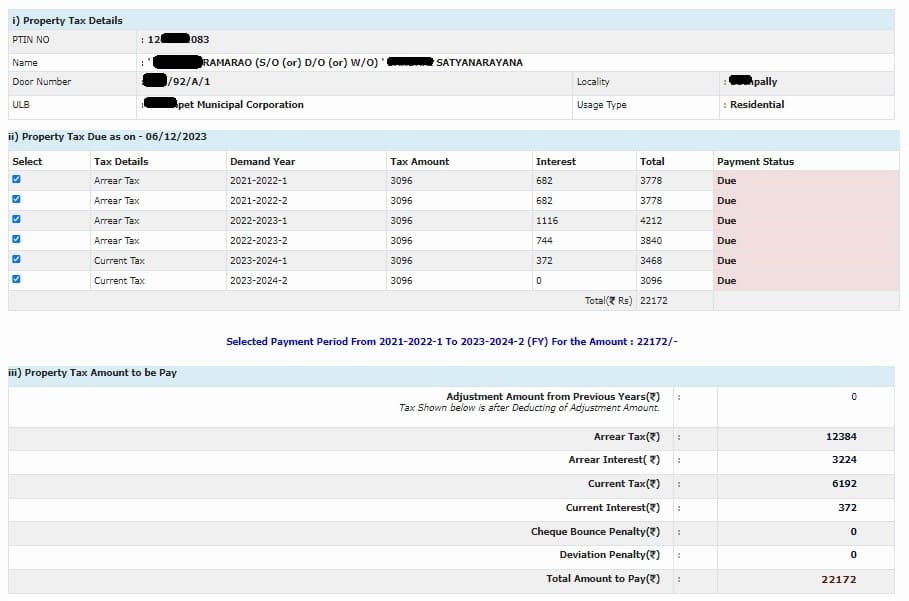

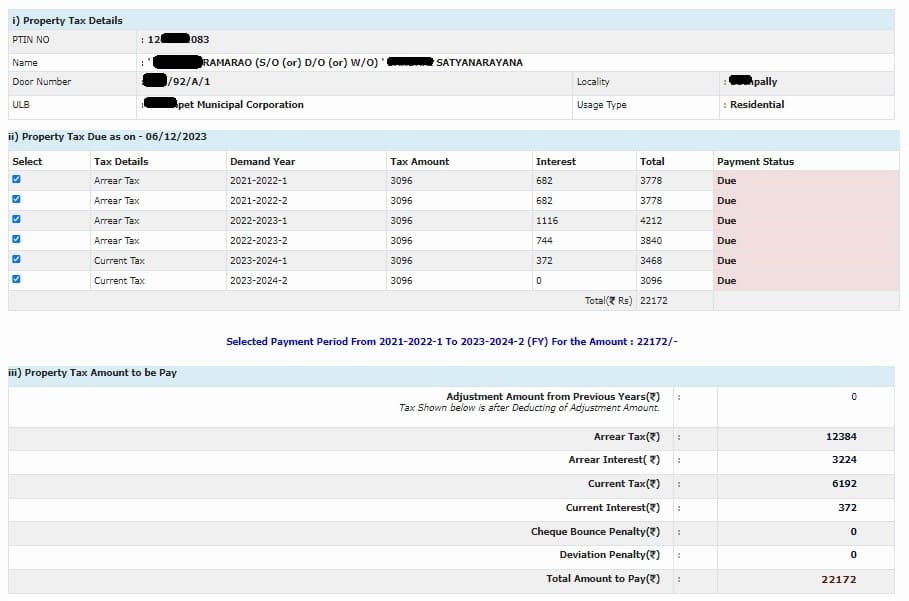

- Review property details and arrears

- Your property details, arrears, and dues will be displayed.

- Check the arrears, dues, and last payments.

- Select the “Demand Year” for which you want to make the payment.

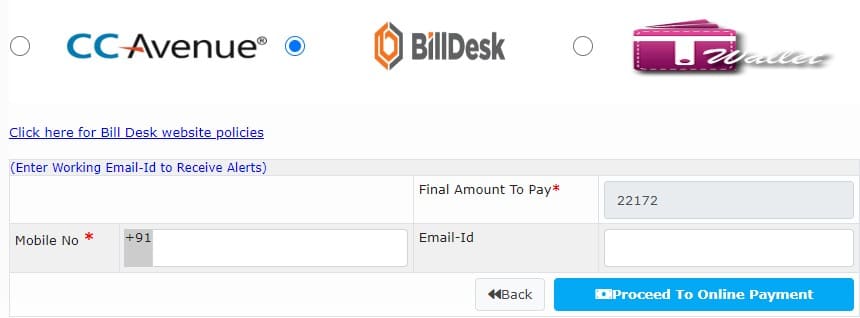

- Select payment method

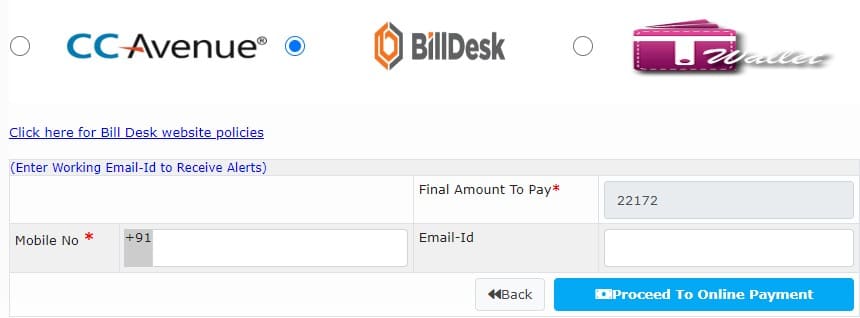

- Choose your desired payment method from the available options: UPI, Netbanking, Credit/Debit Cards, or T Wallet.

- For UPI and Credit/Debit Card payments, select the “BillDesk” option.

- Enter mobile number and email ID

- Enter your registered mobile number in the “Mobile Number” field.

- Optionally, enter your email ID in the “Email ID” field.

- Confirm payment

- Click on the “Confirm Payment” button.

- Download receipt

- Upon successful payment, a receipt will appear.

Click on the receipt to download it.

- Upon successful payment, a receipt will appear.

Download CDMA Property Tax Receipt

The CDMA portal stores all property tax payment receipts in the databases of every CDMA taxpayer. To download your CDMA property tax receipt, follow these steps:

- Visit the CDMA portal.

- Select the “Online Payments” option and then click on the “Property Tax” option.

- Once the property tax services page appears, select the “Print Receipts” option.

- Enter your PTIN number and click “Submit.”

- All available payment receipts will be displayed. This will only show previous payment receipts.

- Select the demand year for the receipt you want to download and click the “Download” option. The property tax receipt will be downloaded to your device.

This receipt serves as valid proof that your property tax payments are complete.

How to Calculate CDMA Property Tax

To calculate your CDMA property tax, you will first need to gather your property’s exact details, such as district, ULB, grama panchayat, colony, and other relevant information.

Once you have this information, you can follow these steps to calculate your CDMA property tax:

- Step 1: Visit the emunicipal portal

- Step 2: Click on the “Property Tax” option.

- Step 3: Select the “Property Tax Calculation” option.

- Step 4: Enter your property details in the form that appears.

- Step 5: Click on the “Add Measurement” option.

- Step 6: You will now be able to see your property tax amount and other relevant details.

The CDMA portal is an online platform that offers various services to residents of Telangana, India. CDMA manages property tax and other taxes and services within its jurisdiction. The portal is user-friendly and easy to navigate. The tax revenue is utilized to finance municipal services like infrastructure development, education, and healthcare. Property tax is determined based on the property’s assessed value.

Sri Arvind Kumar IAS

Special Chief Secretary to Government, MA & UD Department and Commissioner & Director Municipal Administration (FAC)

What is CDMA in Telangana?

Commissioner and Director of Municipal Administration (CDMA):when you’re in Telangana. CDMA is a government department responsible for overseeing and managing various aspects of Rural Municipal administration in the state.

What is the full form of CDMA in municipality?

Commissioner and Director of Municipal Administration (CDMA)