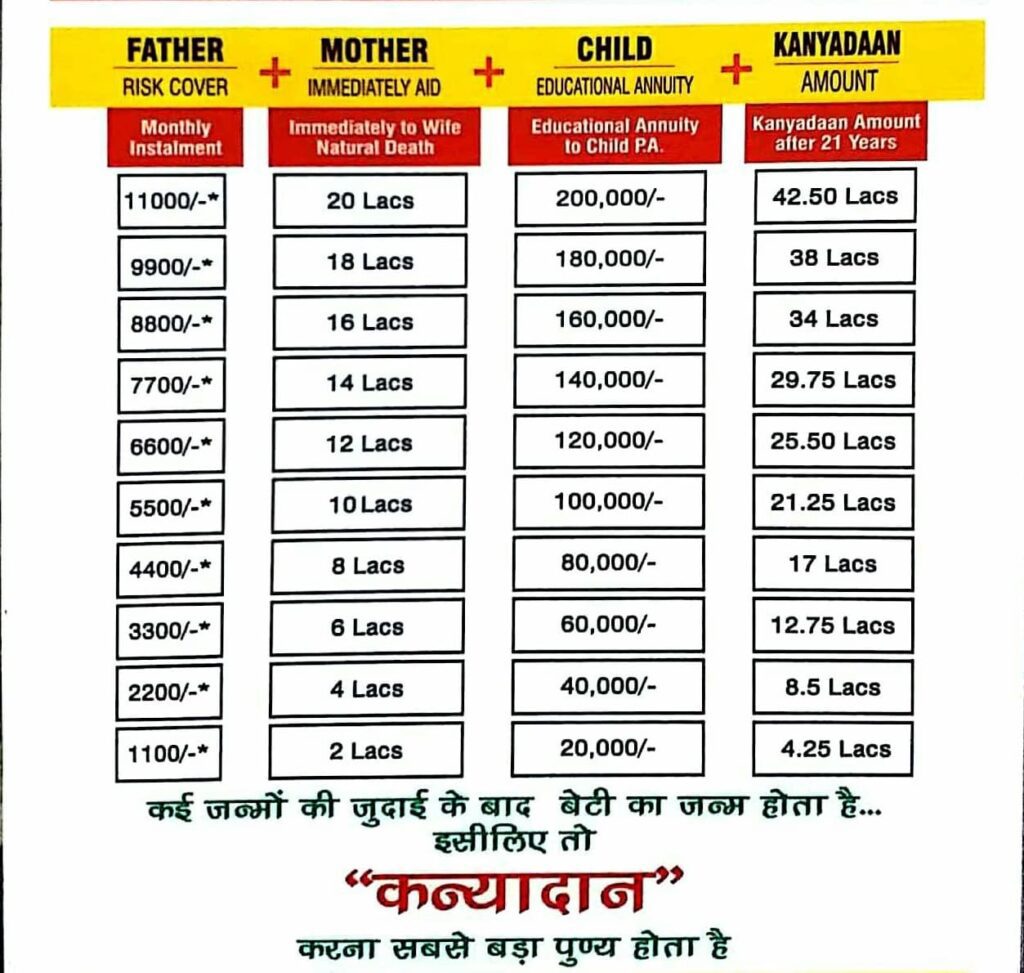

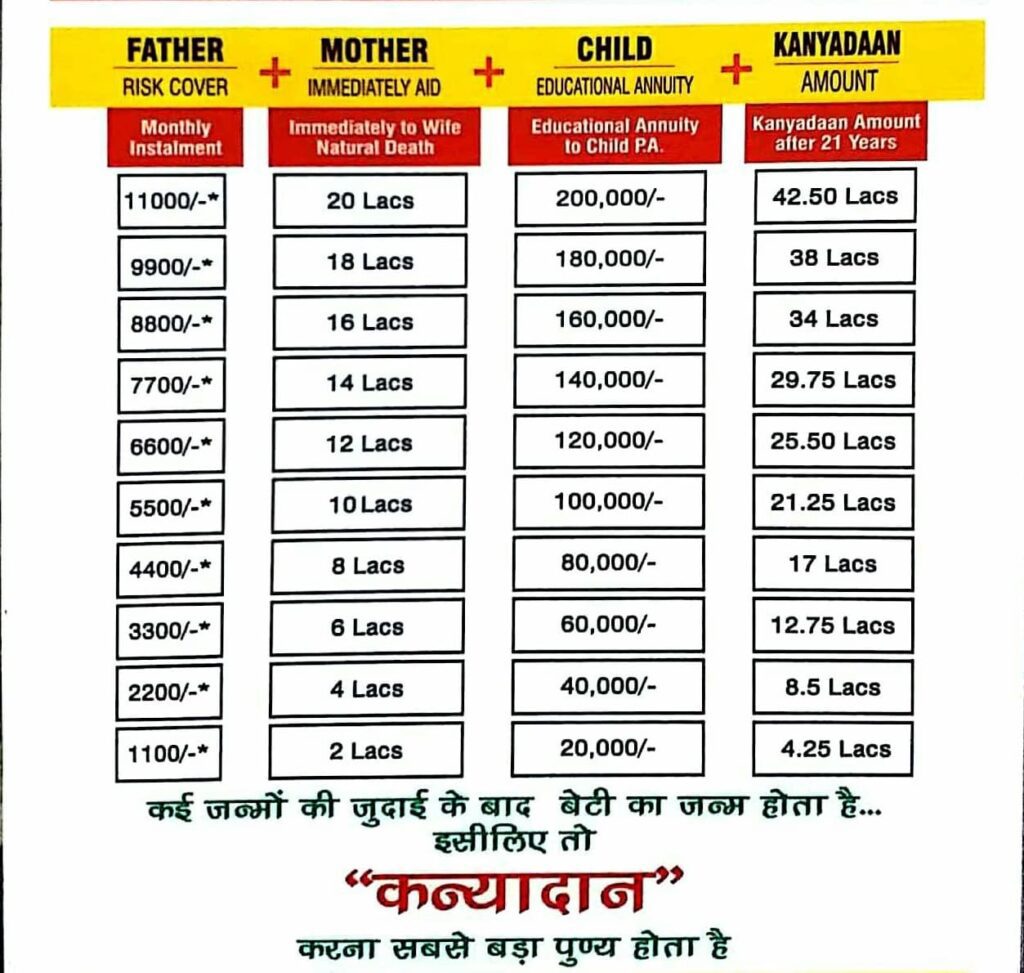

When it comes to your daughter’s future, education and marriage expenses can be quite high. That’s why LIC introduced the LIC Kanyadan Policy, a new policy designed to help you cover these expenses. This policy gives hope to daughters to achieve their dreams without struggling with financial issues in the future. And using the LIC Kanyadan Policy calculator, you can easily calculate the maturity amount and other policy details.

What is LIC Kanyadan Policy

LIC Kanyadan Policy is a child plan offered by Life Insurance Corporation of India (LIC), designed to provide financial protection and savings for a daughter’s education, marriage, or other future endeavors. It is a combination of two LIC policies: LIC Jeevan Lakshya (Plan No. 945) and LIC Umang (Plan No. 933). This policy offers a guaranteed sum assured, regular income option, bonus additions, and flexible premium payment options. It is a valuable tool for parents who want to secure their daughter’s future.

LIC Kanyadan Policy Eligibility

- Parent or legal guardian: The policyholder must be the parent or legal guardian of an unmarried girl child.

- Age of the girl child: The girl child must be between 0 and 12 years old at the time of policy application.

- Policy term: The policy term can be chosen between 10 and 25 years.

- Age of the policyholder: The policyholder must be between 18 and 50 years old at the time of policy application.

- Premium paying term: The premium paying term is less than 3 years than the policy term.

- Minimum sum assured: The minimum sum assured is Rs. 1 lakh.

- Maximum sum assured: The maximum sum assured is Rs. 5 crore.

Kanyadan Policy Required Documents

- Aadhar Card: A valid Aadhar card for the policyholder and the girl child is mandatory.

- Address Proof: A copy of a valid address proof document, such as a utility bill, passport, or voter ID card, is required.

- Passport Size Photo: Two recent passport-size photographs of the policyholder and the girl child are necessary.

- Policy Form (Filled): The completed policy form, signed by the policyholder, is mandatory.

- Income Certificate: An income certificate from the employer or a self-attested declaration of income is required.

- Birth Certificate of the Girl Child: A copy of the girl child’s birth certificate is essential for verification.

Basic Benefits of LIC Kanyadan Policy

- Financial Security: Helps parents save money for their daughter’s future education, marriage, or other expenses.

- Peace of Mind: Provides peace of mind for parents knowing that their daughter will be financially secure even if something happens to them.

- Tax Benefits: Offers tax benefits under Section 80C and Section 10(10D) of the Income Tax Act.

- Guaranteed Returns: Provides a guaranteed return on investment.

- Flexible Payment Options:Your Allows to choose from various premium payment modes, such as monthly, quarterly, half-yearly, or yearly.

- Life Insurance Coverage: Provides life insurance coverage for the policyholder.

- Maturity Benefit: Pays a lump sum amount to the daughter upon policy maturity.

- Additional Benefits: Offers additional benefits such as accidental death benefit, non-accidental death benefit, and annual income benefit.

How to Use LIC Kanyadan Policy Calculator

The policy calculator is a tool used to estimate the maturity amount, regular premiums, and other important aspects to consider before purchasing an insurance policy. In this case, we will use the policy calculator to estimate the details of the LIC Kanyadan Policy.

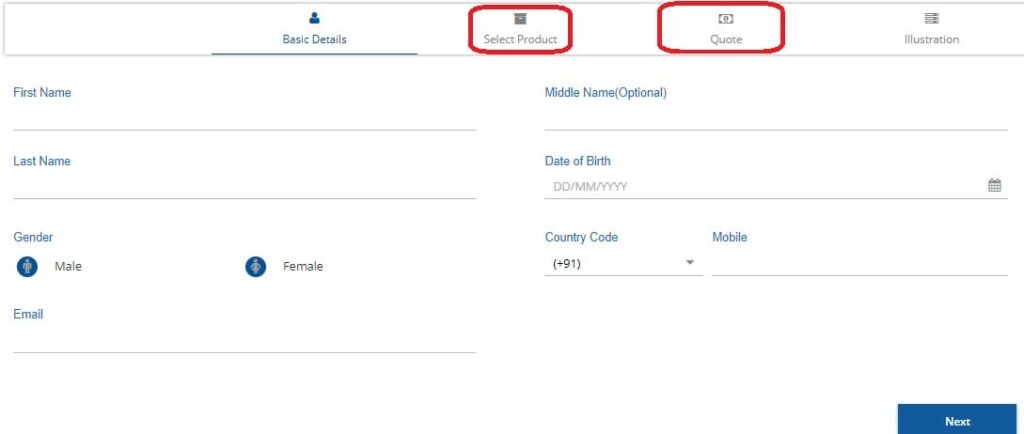

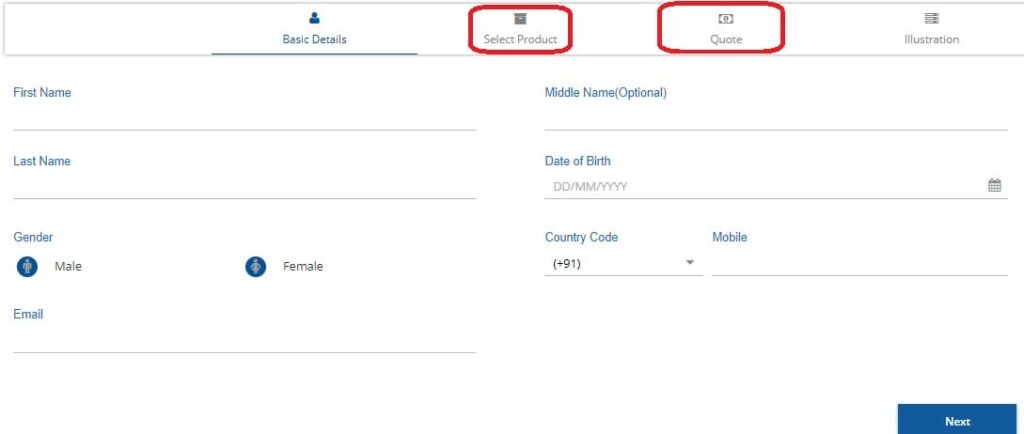

- Visit the official LIC portal: Go to the LIC website and navigate to the ‘Policy Calculator‘ section.

- Select the ‘Quick Quote’ option: Now you will redirect new page enter your basic details and click on next, On next a popup will appear select the ‘Quick Quote’ option.

- Choose the LIC Kanyadan Policy: Since the LIC Kanyadan Policy is a combination of two policies (Jeevan Lakshya (Plan 933) and Jeevan Umang (Plan 945)), select either Jeevan Lakshya or Jeevan Umang and proceed.

- Enter the policy details: Provide the necessary information, such as the daughter’s age, policy term, and desired sum assured.

- Calculate the policy details: Once you’ve entered the required information, click the ‘Calculate’ button to generate the estimated maturity amount, premium amounts, and other relevant details.

Factors Affecting LIC Premium

- Age: Younger people pay lower premiums than older people.

- Gender: Women pay lower premiums than men because they statistically live longer.

- Sum Assured: The higher the sum assured, the higher the premium.

- Type of Plan: Different types of plans have different premiums. Plans with more benefits and longer terms are more expensive.

- Policy Term: Longer policy terms have higher premiums.

LIC Contact details:-

- Phone:- 22-68276827

- SMS :-

- SMS LICHELP to 9222492224.

TS Post-Matric Scholarship Apply for BTech,MBA,MCA,Inter…

The LIC Kanyadan Policy is an excellent choice for securing your daughter’s future. It offers a range of benefits, including guaranteed maturity benefits, regular income options, bonus additions, and flexible premium payment options. If you meet the eligibility criteria, consider using this policy to safeguard your daughter’s financial well-being.

To apply for the LIC Kanyadan Policy, you can contact the LIC team or visit your nearest LIC office. Alternatively, you can explore the Sukanya Samriddhi Yojana, a post office scheme that provides financial security for daughters.